For federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. C corporations conduct business, realize net income or losses, pay taxes, and distribute profits to shareholders. C corporation profits are taxed to the corporation when earned, and then taxed to the shareholders when distributed as dividends. This creates a double tax. In select circumstances, however, net income will be higher, even after the double tax, than it would be for sole proprietors or individuals in the top tax brackets. This in mind, it is important to plan ahead by estimating personal income, business income, and dividends, and evaluating the corresponding tax rates.

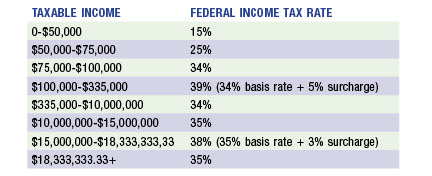

This table specifies the Federal income tax rate schedule for C corporations, current through 2014.