TAX INFORMATION

Health Care Law: Do You Have Minimum Essential Coverage?

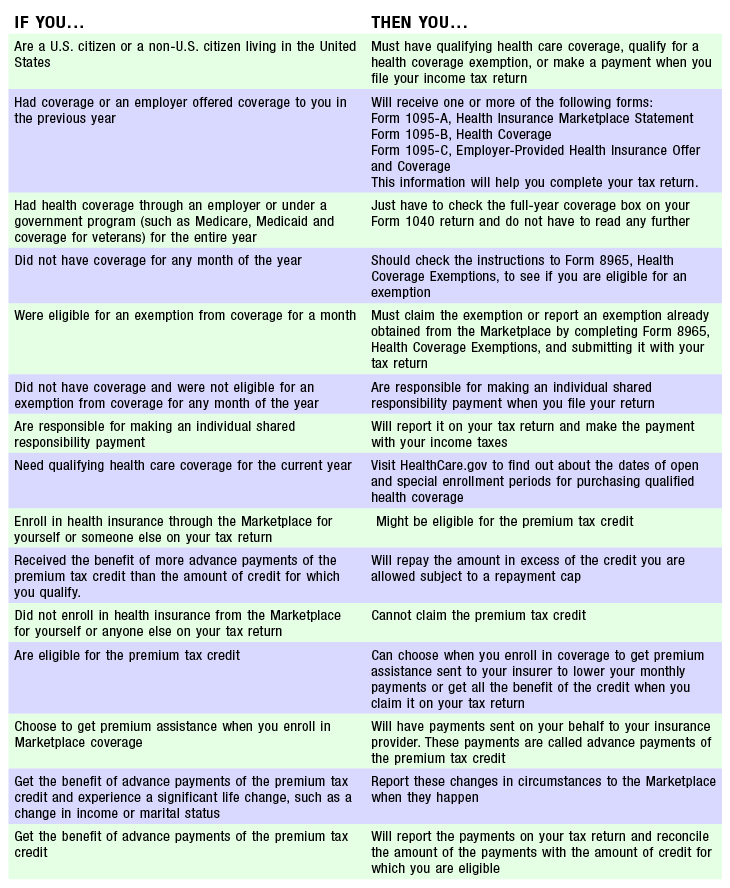

The individual shared responsibility provision requires you and each member of your family to have basic health coverage – also known as minimum essential coverage – qualify for a health coverage exemption, or make an individual shared responsibility payment for months without coverage or an exemption when you file your federal income tax return.

Here are some examples of coverage that qualify as minimum essential coverage:

Employer-sponsored coverage

- Group health insurance coverage for employees under

-

- a governmental plan such as the Federal Employees Health Benefit program

- a plan or coverage offered in the small or large group market within a state

- a grandfathered health plan offered in a group market

- Self-insured group health plan for employees

- COBRA coverage

- Retiree coverage

Individual health coverage:

- Health insurance you purchase directly from an insurance company

- Health insurance you purchase through the Health Insurance Marketplace

- Health insurance provided through a student health plan

Coverage under government-sponsored programs:

- Medicare Part A coverage

- Medicare Advantage plans

- Most Medicaid coverage

- Children’s Health Insurance Program, also known as CHIP

- Most types of TRICARE coverage

- Comprehensive health care programs offered by the Department of Veterans Affairs

- Department of Defense Nonappropriated Fund Health Benefits Program

- Refugee Medical Assistance